|

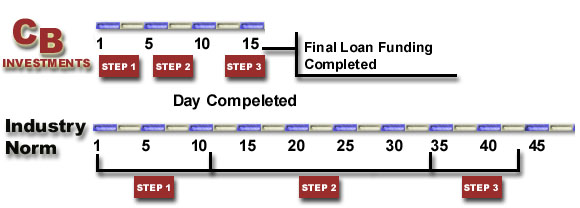

STEP 1 (Upon receipt of complete application) Initial Underwriting (U/W): Approve, suspense, or deny notice issued Third-party reports ordered: credit, appraisal, title, and closing Verifications sent (employment, deposit, mortgage, rent) STEP 2 All reports and verifications in Complete loan package assembled and sent to final underwriter (U/W) STEP 3 Final Loan Funding

|

| Home | | Interest Rates-Prime | | Interest Rates-Subprime | | Obtain Credit Report | | Apply for a Loan | | Real Estate Sales |

| Closing Costs | | Market Commentary | | Contacting Us | | About Us | | 15 Day Mortgage! |

|

Please feel

free to contact us anytime: COLORADO

927 CR 207, Durango 81301

|